Will I Have To Pay Tax If I Win Keno Lotteries In Canada?

Will I have to pay tax if I win Keno lotteries in Canada is the most popular question asked by Canadian punters who play real money slots and lotteries in Canada. The answer is No your real money Keno wins are not taxable in Canada. Gambling income in Canada is tax-free. Whether you play casino games casually or you’re a professional, the question are gambling winnings taxable in Canada then remember that the CRA does not come after your wins. This includes even the progressive slot wins like the $20 million a Canadian won earlier in March while playing the Mega Moolah jackpot game.

1. Gambling Winnings

As you visit the real casinos in Canada to play real money slots, you know that these casinos acquire licenses from provincial administrators. Seven out of 10 provinces permit gambling of some form. Ontario is home to at least 25 gambling establishments, making the province with the highest number of licensed establishments.

The Kahnawake National Reserve is also significant in the country’s gambling scene. While most companies struggle to get licensed in the country, investors from the First nations Tribes are allowed to launch casino establishments easier.

When playing real money slots at online casinos which are located offshore or internationally, most casinos with servers in Canada also tend to base them in the Kahnawake reserve. Though Canada doesn’t permit remote gambling licenses except in rare cases, the government also doesn’t prohibit Canadians from gambling on foreign casinos.

This means you can join any online Canadian-friendly casino with your cell phone or PC or tablet and play slots, or table games without government interference. If you win money, you’re allowed to keep it without having to pay taxes.

2. Lottery Winnings

You play Canada’s most popular lottery 649 and you are the winner. So are gambling winnings taxable in Canada? Obviously, you will have plans to spend your treasure to travel around the world or have a grand mansion for yourself, a limousine to drive and various other dreams to fulfill. No matter what you do with your winnings remember if your winnings are from a Canadian lottery, you’ll be able to enjoy the entire amount tax-free.

Playing lotteries in Canada are tax-free

Canucks are lucky when it comes to lottery winnings. Winnings from a Canadian lottery such Lotto Max or 649 are considered to be windfalls. Even winnings from sweepstakes or lottery sponsored by a charitable organization are generally tax-free. Everything from your local hockey team’s 50/50 draw to the Big Brothers/Big Sisters travel lotto vouchers is included in the windfall category and therefore exempt from tax.

The Canada Revenue Agency (CRA) does not require you to pay tax on the winnings themselves. However, as with most other types of income, you will be subject to tax on any money your windfall generates. If you simply put your millions in the bank, only the interest your money makes will be taxable.

Now if you score big from a Canadian casino, your winnings will be treated the same as other lotteries and usually remain tax-free.

However, over the past few years, CRA has begun to examine its policies for professional gamblers, classifying “winnings” as business income and therefore taxable like any other business income. At the same time, this also means professional gamblers can claim business expenses. For example, if you’re considered to be a self-employed professional poker player under this theory, you could deduct all of your travel expenses, tournament fees, etc. from any winnings. If you didn’t win enough to cover the expenses, you’d be able to claim a business loss.

Workplace contests lottery are taxed

Prizes won from your place of employment aren’t always tax-free. Cash awards or near-cash awards such as gift cards, are almost always considered to be taxable employment benefits. This means the award will be considered as part of your income. Your employer will deduct income tax, Canada Pension Plan and in some cases, even Employment Insurance premiums on this type of award. Your T4 will have the amount of the taxable benefit listed in box 40.

3. Gambling in USA or Vegas as a Canadian citizen

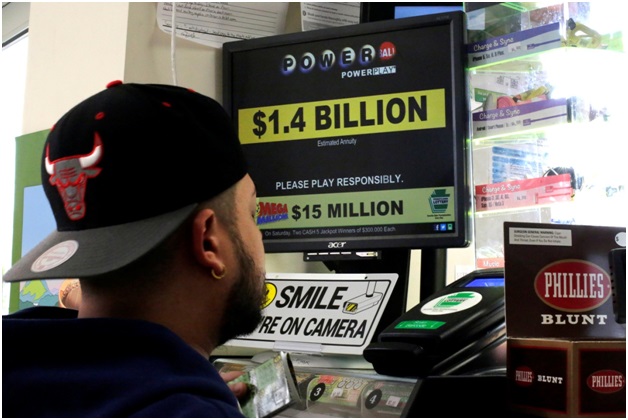

If you wish to play lottery or casino games in Las Vegas or the US then are gambling winnings taxable in Canada? You pick up a US Powerball ticket may be tempting, but the US Internal Revenue Service (IRS) has a different approach to your lottery winnings than the CRA, and considers all winnings to be taxable. And that includes a portion of your windfall from all US casinos and lotteries.

So as a Canadian winning a US lottery you would still be responsible for American tax obligations. With a lottery winning you would have to file a US tax return. Also if you hit the jackpot at a casino, a good amount of those winnings to be withheld by the casino to ensure your tax obligations are met before you even leave the country. Even if you win big from your own home on a US online poker site, for example, your big score will be considered to be American income and taxed accordingly.

However, the law offers a small loophole as the Canadian Income Tax Act does not impose any taxes even on lottery earnings generated outside Canada. Hence, the Canadian residents, who win an American lottery are obliged to pay only a 30% tax on their winnings to the US Internal Revenue Service (IRS).

Following the established British model, gambling winnings in Canada are not taxable, therefore gambling losses are not deductible. Canadian players can place their bets without worrying that the government will take a massive chunk of their fairly earned money. And taxed or not, it is the fun of the game that should be players’ drive.

You will be now thinking why then go to neighbours house to play. Canadian home is much better for lotteries and winnings in terms of tax. Isn’t it.

Finally, note that whether you play at online casino or land casino your wins are not taxable. So winning gamblers in Canada does not have to pay tax in Canada if you don’t make a living with gambling and are therefore not a “professional gambler” in the eyes of the Canadian Revenue Agency, you pay absolutely zero income tax on your gambling winnings regardless of what kind of game or contest you play.

You will not face any legal action if you are winner at casinos whether pay at real physical venues in Canada or play at online casinos because all the wins are tax free.

But if you are working at any Canadian casino and fail to disclose the gifts or tips that you receive in your tax returns you will have to face the consequences.